Definition Of An Equity Warrant

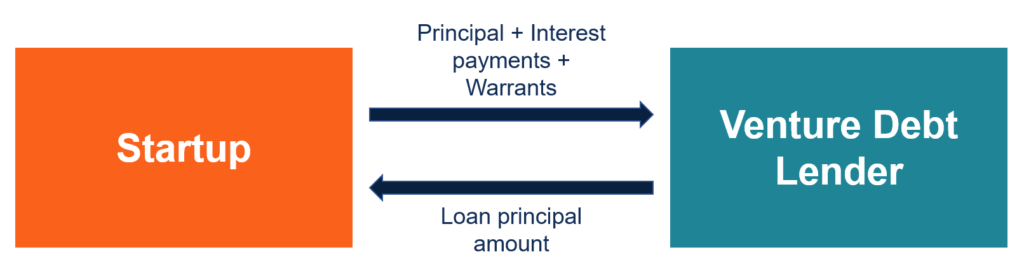

Assume that the debt is structured as a warrant where the lenders are given the option to buy a certain amount of stocks at a particular price at a future date.

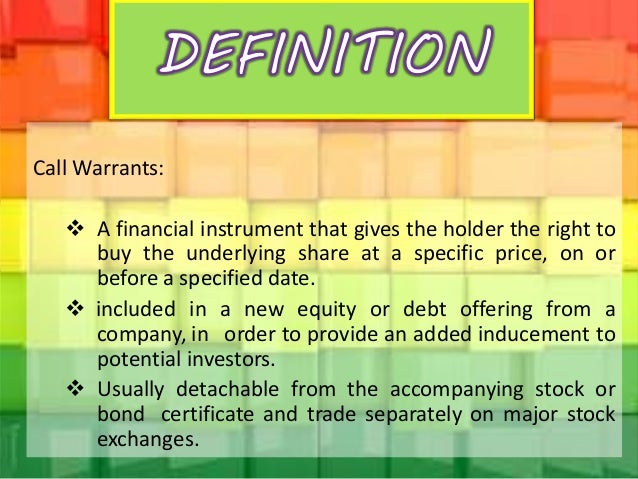

Definition of an equity warrant. A rights offering is a set of. A put warrant sets a certain amount of equity that can be sold back to the company at a given price. A stock warrant differs from an option in two key ways. That is an equity warrant is a certificate issued with a security giving the holder the option of buying a stock at a certain strike price for a certain period of time.

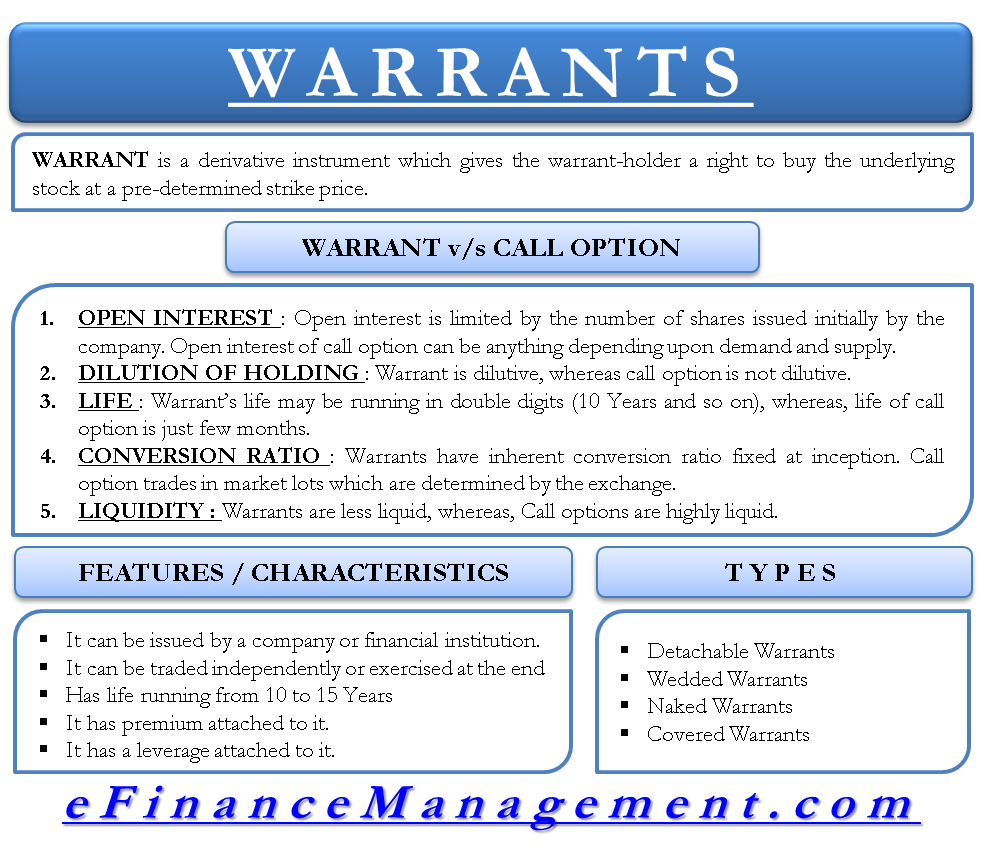

Equity warrants can be call and put warrants. A warrant is an equity derivative that shares many of the same characteristics with options but with a few key differences. Just as in the case of a standard equity option a warrant provides the holder with the right but not the obligation to buy a stock at a specified price the strike price either on the expiry date in the case of a. Equity warrants are instruments that bestow upon the holder of the instrument the right to buy a particular stock at a predetermined price within a stipulated time frame however to gain this right the buyer of such warrants usually needs to make an upfront payment to the warrants issuer.

Both have a certain date of expiration. On exercise of such warrants fresh shares are issued by the issuer company. Equity warrant a warrant in which the underlying security is a stock. Callable warrants offer investors the right to buy shares of a company from that company at a specific price at a future date prior to expiration.

An equity kicker is an equity incentive where the lender provides credit at a lower interest rate and in exchange gets an equity position in the borrower s company. Unlike options warrants are issued by companies during a round of. Until the call date of the host asset is reached the warrant can only. Acquiring firms prefer not to have a warrant holder acquiring equity in the acquirer.

Option to buy the equity security of the issuer of a debt security such as a bond at a specified price up to a specified expiration date. The target firms have to pay off warrant holders prior to closing while disclosing a potential merger. A warrant that can only be exercised if the host asset typically a bond or preferred stock is surrendered. The reasons you might invest in one type of warrant may be different from the reasons you might invest in another type of warrant.

Equity warrants are the most common warrants.