Definition Of Disability Cra

The person is significantly restricted in 2 or more of the basic activities of daily living or in vision and one or more of the basic activities of daily living even with appropriate therapy medication and devices.

Definition of disability cra. With that being said if your doctor has documented your physical or mental impairment and can provide information regarding the nature commencement and the duration of your impairment you ll qualify for certain. The majority of my recent research has focused on accessibility related issues. December 2019 january 2020 motion to request that the ontario minister of children community and social services maintains the definition of disability for recipients of the ontario disability support program was adopted by toronto city council ottawa city council region of peel council and hamilton city council. Simon applied for the disability tax credit dtc.

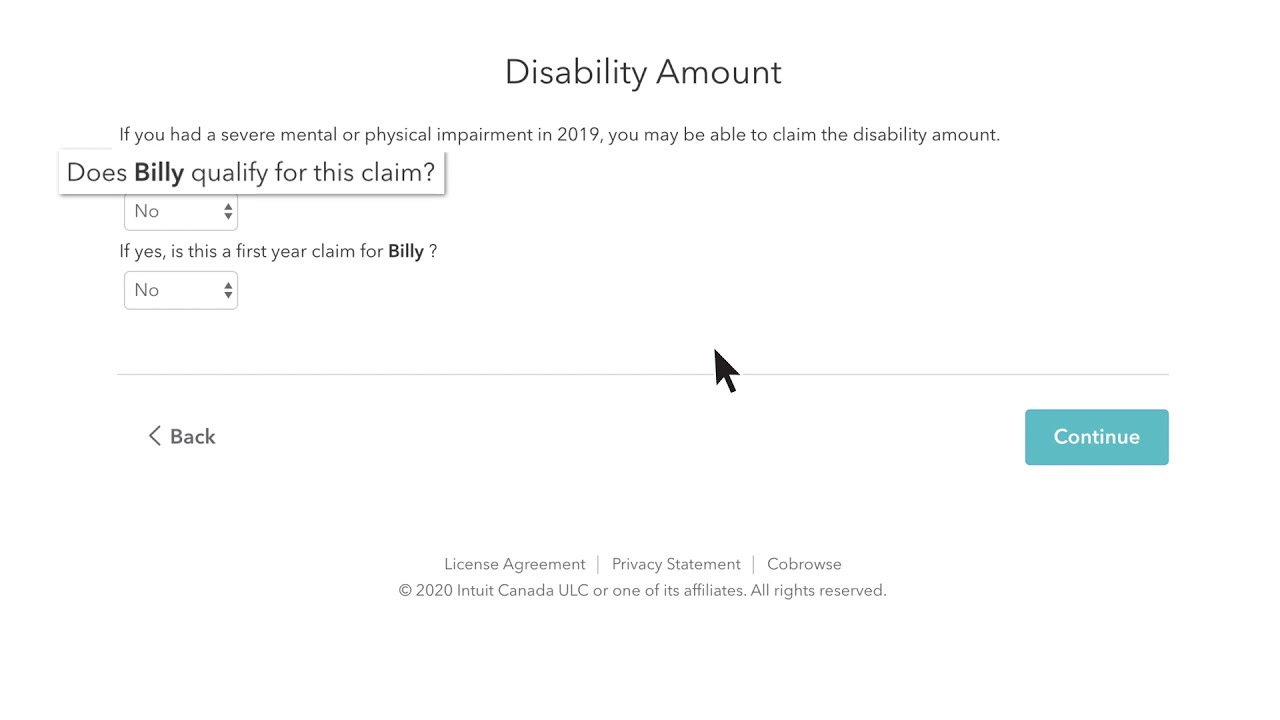

Or social functions are not included in the definition of basic activities of daily living for the purposes of the disability tax credit. One of the most common disability tax credit related questions we receive on a daily basis is whether a person living with a disability in canada should apply for the disability tax credit or cpp disability benefits. The disability tax credit is a non refundable tax credit created by the canadian government and canada revenue agency cra in order to reduce the amount of income tax canadians with disabilities and or their families supporters would have to pay annually. Answering this question can be difficult especially considering the income tax act doesn t offer a clear definition of what it means to be infirm or suffer from a disability.

Child care deduction an enhanced child care deduction of up to 11 000 can be claimed for disabled dependants but only if they qualify for the disability amount and have a disability tax credit certificate signed by a medical practitioner and accepted by cra. Since simon is eligible for the dtc he may also be eligible for other government programs for persons with disabilities. Thanks to the information that the medical practitioner provided on the dtc application form he is now eligible for the tax credit because he is blind. Canada revenue agency has indicated that as a guideline substantially all of the time means that the restrictions in activity are present 90 of the time or more 7 all of this information is reported to canada revenue agency via the t2201 disability tax credit certificate.

Disability supports deduction a medical doctor must certify that the. Other credits for infirm and disabled taxpayers include. While both are designed to help differently abled canadians maintain a high standard of living and provide financial stability and security these canadian disability programs. To be eligible for the dtc under cumulative effect the person needs to meet all of the following criteria.

Working with my students our research employs a broad definition of accessibility seeking to empower individuals with disabilities as well as individuals who. My research focuses on empowering individuals through computing technologies that more effectively match their knowledge experience abilities and goals. The fact that a person has a job does not disqualify that person from the disability tax credit.