Definition Of Family Under Epf Act

The epf fund should be then distributed to legal heirs of the employee as per the legal heir s law.

Definition of family under epf act. This is the reason it is always best that epf nomination should be your legal heir itself. Section 2 of employees provident funds miscellaneous provisions act 1952 definitions in this act unless the context otherwise requires a appropriate government means. The department of labor issued a final rule on february 25 2015 revising the regulatory definition of spouse under the family and medical leave act of 1993 fmla. The employee contribution to the epf can be claimed for the deductions under section 80 c of the income tax act.

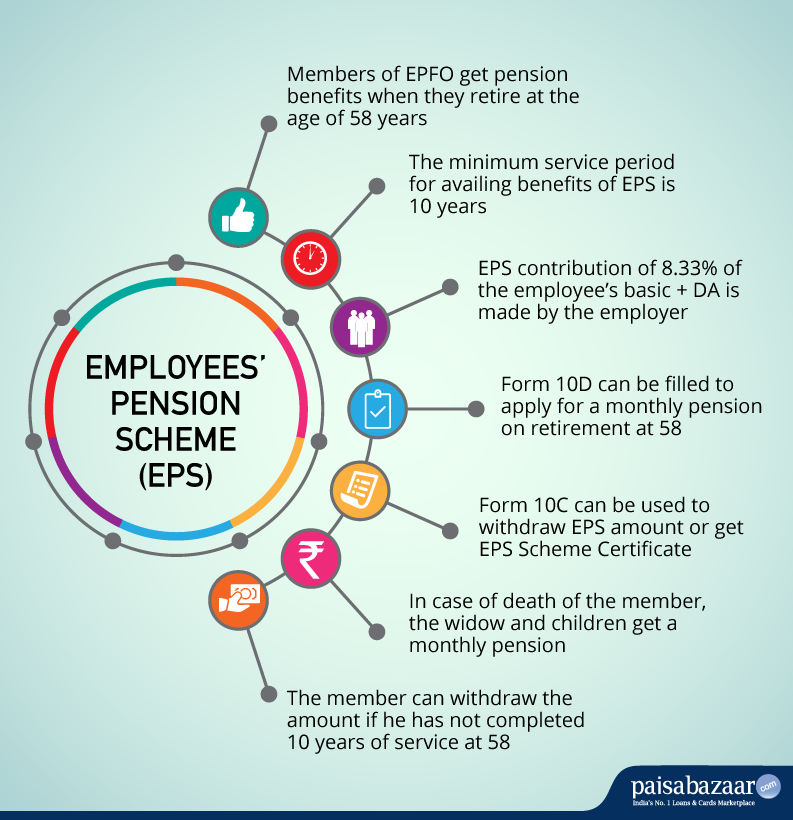

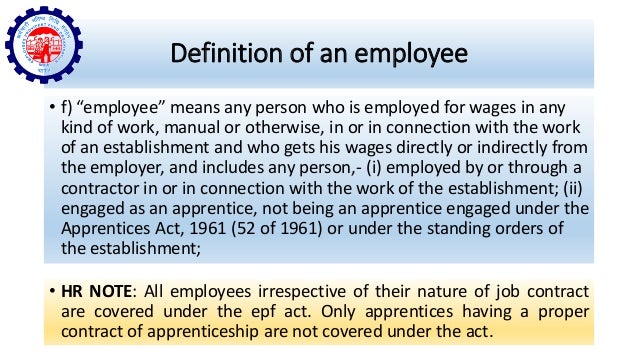

However an employee cannot nominate his brother and sister for epf. Kasturirangan says under the epf act i in the case of a male member family means his wife his children whether married or unmarried his dependent parents and his deceased son s widow and children and. Member having family can nominate any one or more of the family members as defined under the para 2 f of the epf scheme 1952. Employee provident fund epf is a society security fund created for the purpose of providing financial security and stability during retirement.

Otherwise you will create a legal tussle with your family in your absence. Fff exempted 4 establishment means 5. Provisions under this section of epf act 1952 is. The following are the epf withdrawals rules.

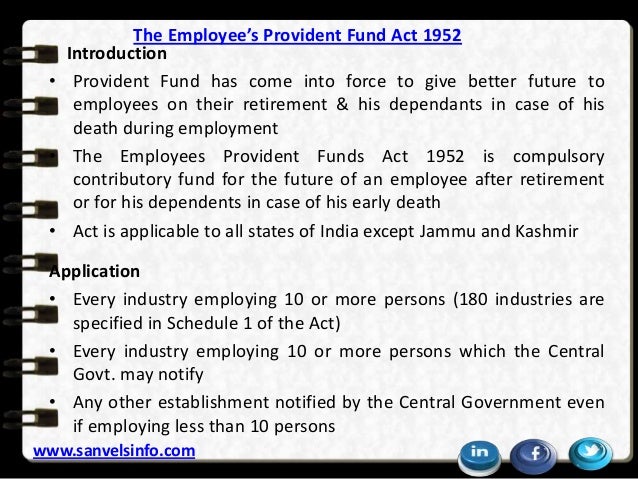

Employees provident fund is established in 1952 and hence the act is named as employees provident fund miscellaneous provisions act 1952 which extend to the whole of india except jammu kashmir. Rules of nomination in epf and eps account as per the epf act only defined family members can be nominated in an epf account. The fmla entitles eligible employees of covered employers to take unpaid job protected leave for specified family and medical reasons. In the case of a cessation of.

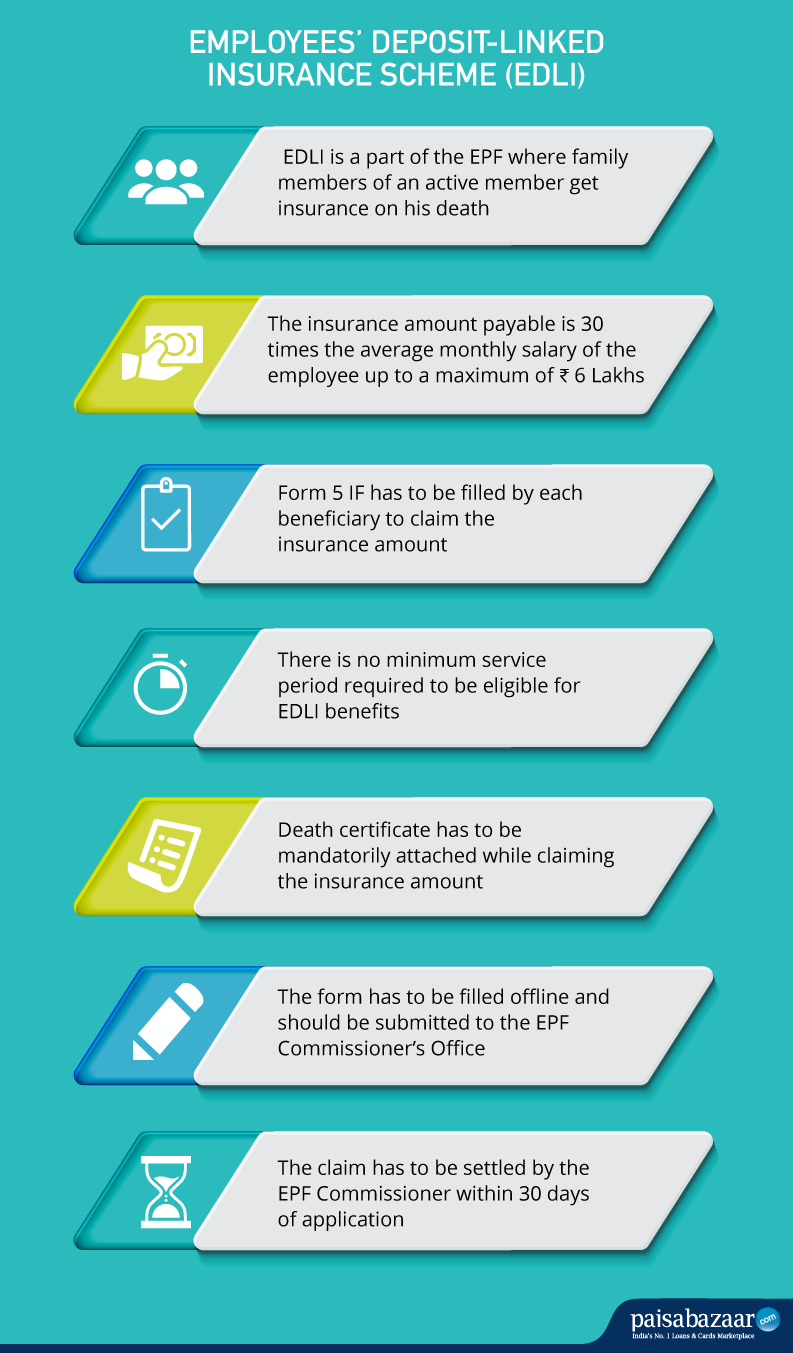

Employee provident fund epf provident fund is a welfare scheme for the benefits of the employees. 5 ii engaged as an apprentice not being an apprentice engaged under the apprentices act 1961 52 of 1961 or under the standing orders of the establishment 1 ff exempted employee means an employee to whom a scheme 2 or the insurance scheme as the case may be would but for the exemption granted under3 section 17 have applied. The employer is also obliged to contribute an equal amount as specified by the act towards epf of the employees. An employee cannot withdraw a full epf balance before attaining the age of retirement.